Learn Together

Suggested time: 70 mins

Article

(10 mins)

Read the following article and find key points to share in our upcoming discussion.

Fund your business - A comparison from the U.S. Small Business Administration

Reading: Revenue and Pricing Models

(15 mins)

Let’s learn about the types of models for generating revenue and pricing products and services.

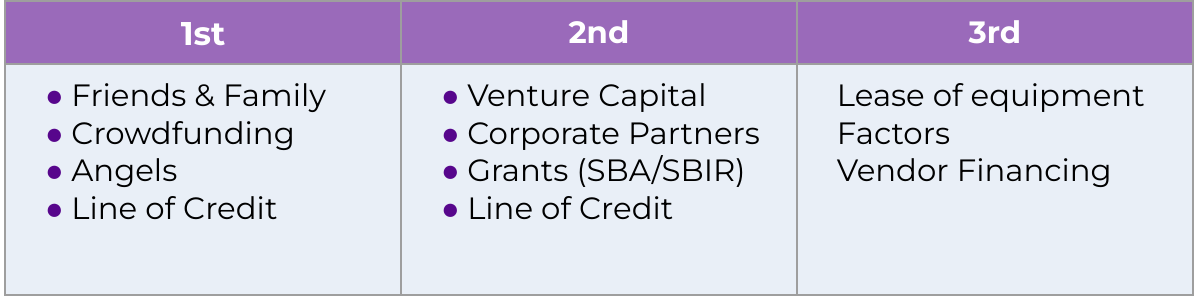

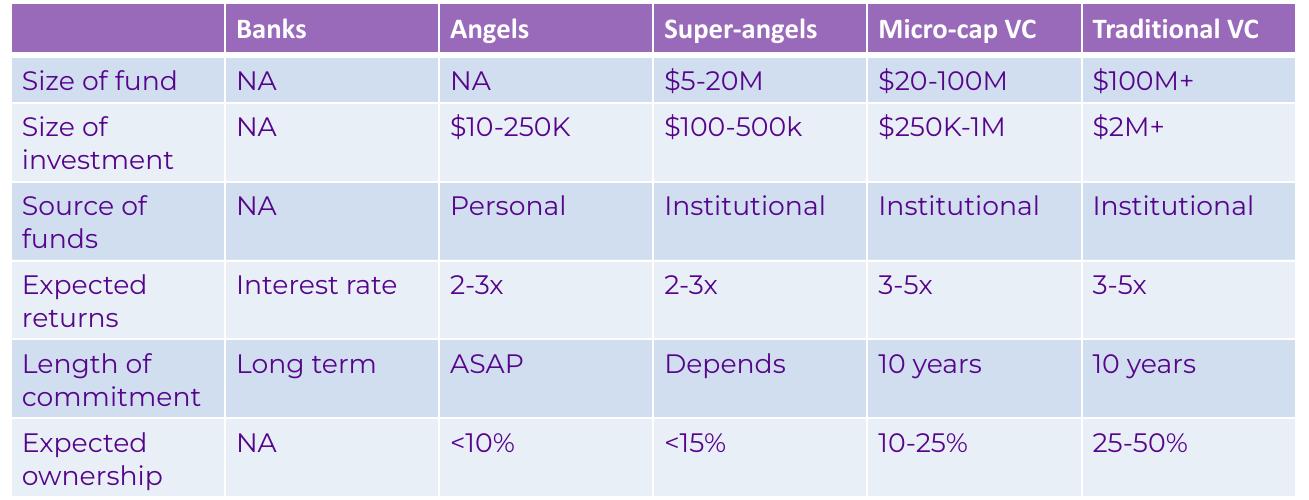

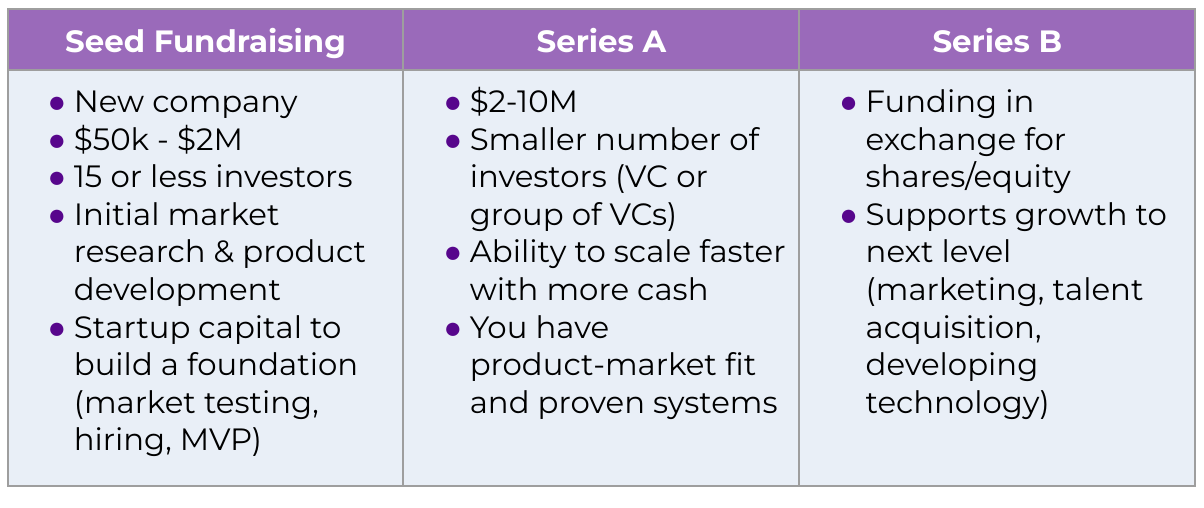

The following tables offer a quick overview of different types of financial resources available when funding your business:

Types of Financial Resources

Comparing Sources of Funding

Types of Fundraising

Working Capital Management For our purposes, we’ll define Working Capital (WC) as our Net Working Capital

WC = Current Assets (CA) - Current Liabilities (CL)

A Current Asset is a company’s cash and its other assets that are expected to be converted to cash within one year of the date appearing in the heading of the company’s balance sheet. Liquidity is a company’s ability to convert its assets to cash in order to pay its liabilities when they are due. Liquid assets are easily convertible to cash (or are already cash). Cash is king (or queen)!

Examples (in order of liquidity):

- Cash and cash equivalents (which includes currency, checking accounts, petty cash, some U.S. Treasury Bills)

- Accounts receivable

- Inventory

- Supplies

- Prepaid expenses

A Current Liability is an obligation that will be due within one year of the date of the company’s balance sheet, and will require the use of a current asset or will create another current liability.

Examples:

- Accounts payable or trade payables

- Notes payable that will be due within one year

- The principal portion of a long-term loan that must be paid within one year

- Wages payable

- Income taxes payable

- Interest payable

- Other accrued expenses payable

- Deferred revenues and customer deposits

We can also think of working capital as the liquid assets that the company owns minus the bills that need to be paid soon.

NOTE: An increase in working capital doesn’t always translate to an increase in liquidity!

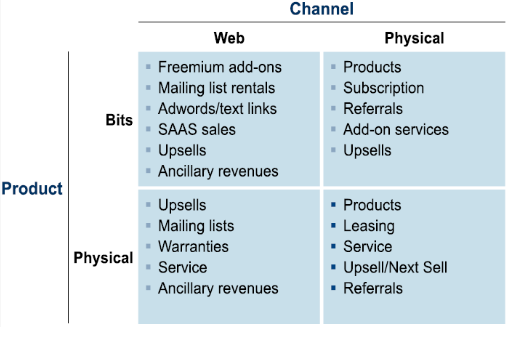

Revenue & Pricing

A revenue model is the strategy the company uses to generate cash from each customer segment. It’s a response to the following key questions:

How many will you sell?

- What was the Market size and estimate of market share?

- Translate into the anticipated number of customers (as in 10% of a million-person market = 100,000 customers)

- How many can your channel sell?

- How much will the channel cost?

- How many customer activations?

- Revenue? Churn/Attrition rate? customers/?

- How much will it cost to acquire a customer?

- How many units will they buy from each of these efforts?

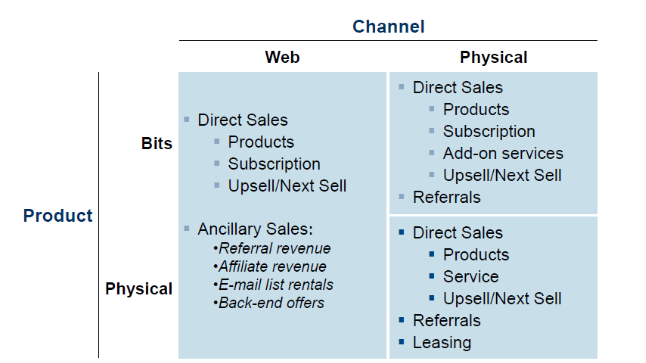

Where is the money coming from?

Web + Mobile Revenue Models:

- Direct revenue models refer to the primary way a business generates revenue, usually through the sale of its core products or services. For example, a software company’s direct revenue model would be the sale of its software product.

- Advertising: Revenue is generated by displaying ads within the web or mobile app to users. Advertisers pay the web or mobile business for the ad space.

- Freemium: Revenue is generated by offering a basic version of the web or mobile app for free, while charging users for premium features or services.

- Virtual goods: Revenue is generated by allowing users to purchase virtual goods or premium features within the app.

- Subscription: Revenue is generated by charging users a recurring fee for access to the web or mobile app or its premium features.

- Pay-per-use: Revenue is generated on a per-use basis.

- Ancillary revenue models refer to additional revenue streams that a business can generate outside of its core products or services. These revenue streams can include complementary products, services, or advertising. For example, a software company’s ancillary revenue model could include advertising revenue from displaying ads within their software product, or revenue from offering premium customer support services to customers.

- Referral revenue: Businesses can incentivize customers to refer new customers to their products or services, often with discounts or rewards.

- Affiliate revenue: Businesses can earn commission by promoting other companies’ products or services to their customers.

- Data monetization: Businesses can monetize the data they collect from customers by selling it to third-party companies or using it to improve their own products and services, such as through email list rentals.

- Back-end offers: Businesses can promote add-on sales items from other companies as part of their registration or purchase confirmation processes, or “sell” their existing traffic to a company that strives to monetize it and share the resulting revenue

The key difference between direct and ancillary revenue models is that direct revenue models are the main source of revenue for the business, while ancillary revenue models are additional streams of revenue that support the business’s core offerings.

Physical Revenue Models

- Asset sale: Revenue is generated by selling a physical or digital asset, such as a product or software license, to a customer for a one-time fee.

- Usage fee: Revenue is generated by charging customers for the amount they use a product or service, such as a pay-per-use model.

- Ex: FedEx, cellular data plans, and Amazon Web Services

- Subscription fee: Revenue is generated by charging customers a recurring fee for access to a product or service, usually on a monthly or annual basis.

- Ex: Netflix

- Renting: Revenue is generated by renting out physical or digital assets to customers, such as equipment or software, for a specified period of time.

- Ex: Chegg

- Licensing: Revenue is generated by granting the right to use a product or service to another party for a fee, such as licensing software to other businesses.

- Ex: Microsoft Office

- Intermediation fee: Revenue is generated by acting as a middleman between buyers and sellers and charging a fee for facilitating the transaction, such as a commission on sales made through a platform.

- Ex: Etsy

- Advertising: Revenue is generated by displaying ads to customers, with businesses paying for the ad space or for clicks on the ad.

- Ex: Google, Facebook

Pricing Models

Let’s review different pricing models.

The following pricing models are for physical products:

- Product-based pricing: Pricing is based on the cost of producing the product plus a markup. Competitive pricing: Pricing is based on the prices charged by competitors in the market.

- Volume pricing: Discounts are offered for large orders or purchases.

- Value pricing: Pricing is based on the value of the product or service to the customer rather than the cost of producing it.

- Portfolio pricing: Pricing is based on the total value of a bundle of products or services.

- The “razor/razor blade” model: Pricing is based on selling a primary product at a low price, with the expectation that customers will need to buy complementary products at a higher price.

- Subscription: Customers pay a recurring fee to access a product or service.

- Time/Hourly Billing: Pricing is based on the amount of time spent on a project or providing a service.

- Leasing: Customers pay a fee to rent a product for a specified period of time.

The following pricing models are for web/mobile/cloud products:

- Product-based pricing: Customers pay a one-time fee to purchase the product.

- Subscriptions: Customers pay a recurring fee at regular intervals (such as monthly or annually) to access and use a service or product. It often offers additional benefits or exclusive features to subscribers.

- Freemium: This pricing model offers a basic version of a product or service for free, with limited features or functionality. However, customers have the option to upgrade to a paid version, which provides more advanced features or removes restrictions.

- Pay-per-use: Customers are charged based on their actual usage or consumption of a product or service. They pay for the specific resources or features they use, rather than a flat fee.

- Virtual goods: This pricing model is commonly used in online games or virtual environments. Customers can purchase virtual items, such as virtual currency, accessories, or enhancements, to enhance their experience within the digital platform.

- Advertising sales: This model involves generating revenue by selling advertising space or placements within a web, mobile, or cloud product. Advertisers pay to display their ads to the product’s users, and the revenue is generated through these advertising transactions.

Other Terms Used in Place of “Price”:

- Fee

- Commission

- Subscription

- Toll

- Interest

- Rent

- Tax

- Shipping

Article

(10 mins) How to Read and Understand a Cash Flow Statement

Discussion (15 mins)

Review the concepts in today’s readings. Did anything feel particularly interesting or confusing? Answer one another’s questions and commit to finding answers after the session if any questions remain.

(20 mins) Breakout Rooms:

Give and receive feedback on one another’s executive summaries.